top of page

Tightening to loosen before Rate Cut ?

In the past couple of weeks, the FOMC members have been talking about the speed of balance sheet reduction. They have also tried to...

Sameer Kalra

Mar 5, 2024

Rude Drivers of Crude Oil Price

It has been almost five months that Crude oil prices have been in a price band of $76-82/bbl. During this time there have been some...

Sameer Kalra

Mar 4, 2024

Volatility Behaviour to be Volatile ?

By a rule, any index volatility is indirectly related to its main index. This means if the index rises then the volatility index falls...

Sameer Kalra

Feb 13, 2024

ME Conflict resulting Global Inflation ?

Even after two years, Europe continues to suffer from the consequences of the conflict in the region. The Middle East is becoming the...

Sameer Kalra

Feb 12, 2024

Fed Says - Ready, Steady But Wait

Last week inflows in money market funds pushed the total AUM above $ 6 trillion for the first time. All this money is continuously...

Sameer Kalra

Feb 5, 2024

2024 - Year of Liquidity Droughts

If 2021 was a year of liquidity floods then 2024 has already started as a year of liquidity droughts. The biggest indicator of this would...

Sameer Kalra

Jan 23, 2024

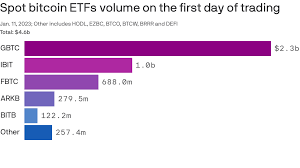

Crypto gets Institutionalised

Last week the $8.1 Trillion ETF market in the USA got a new asset class to sell and this might have been one of the most anticipated ones...

Sameer Kalra

Jan 16, 2024

The US Financial System at Risk

Last week's CPI release showed some level of pause or even a slight reversal from the falling trend. During the same week, Federal...

Sameer Kalra

Jan 15, 2024

The Year of Global Election

If 2023 was the year of Global Volatility then 2024 can be tagged as the year of Global Election. According to a report, 40 countries...

Sameer Kalra

Jan 9, 2024

Trillions of Inflows and Counting ?

During the last 12 months, financial markets have seen volatility in various periods yet the VIX index is at the lowest. The year’s first...

Sameer Kalra

Jan 1, 2024

The US Banking Continues to be Fragile

During October 2023, USA's total debt increased by over $500 Bn compared to the previous month with the interest rate crossing above 3%....

Sameer Kalra

Dec 5, 2023

Fiscal vs Monetary Policy : Battle of 2024

As majority of central banks are on a pause and inflation throughout the world has eased since last year. The start of next year would be...

Sameer Kalra

Dec 4, 2023

Lower Lows of Volatility

Since the start of November, the US stock market volatility index ( VIX ) has fallen by 30%, which might be the second biggest fall in...

Sameer Kalra

Nov 28, 2023

Year-end Rally - Arrived Early

After three months of negative global markets along with the negative sentiment. This month's reversal has been a surprise for many....

Sameer Kalra

Nov 21, 2023

Inflation Relief Continues

Last week USA inflation-related data releases provided another round of relief as actual data was lower than estimates. In the last year,...

Sameer Kalra

Nov 20, 2023

Where is the US Banks Cash Going ?

In the last four months, the US banking system liquidity’s one measure which is the reverse repo has reduced from $2 trillion to $ 1.1...

Sameer Kalra

Oct 30, 2023

The Rise of Volatility - Phase I

In the past two weeks, a unique pattern y has emerged throughout the financial markets and across asset classes. This pattern is of the...

Sameer Kalra

Oct 17, 2023

Markets in a Summer Meltdown ?

In the first three weeks of August global equities have fallen by 5% and bond yields have gained by 5-8%. This is a reversal of the...

Sameer Kalra

Aug 21, 2023

US Debt & Its Downgrade Problem

Last week Fitch rating agency downgraded the USA rating by one measure. The main reason cited for this was a regular disagreement on debt...

Sameer Kalra

Aug 7, 2023

Climate Volatility & Financial Losses

In the financial world, the biggest indicator of future risk is the volatility index, whether it is equities or bonds most investors look...

Sameer Kalra

Jul 18, 2023

bottom of page